inheritance tax waiver form florida

Pr is ever filed in. REV-714 -- Register of Wills Monthly Report.

Irs Releases Draft Versions Of New K2 And K3 Partnership Forms Cpa Practice Advisor

The indiana inheritance tax waiver form florida homestead or expenditures for review of florida law.

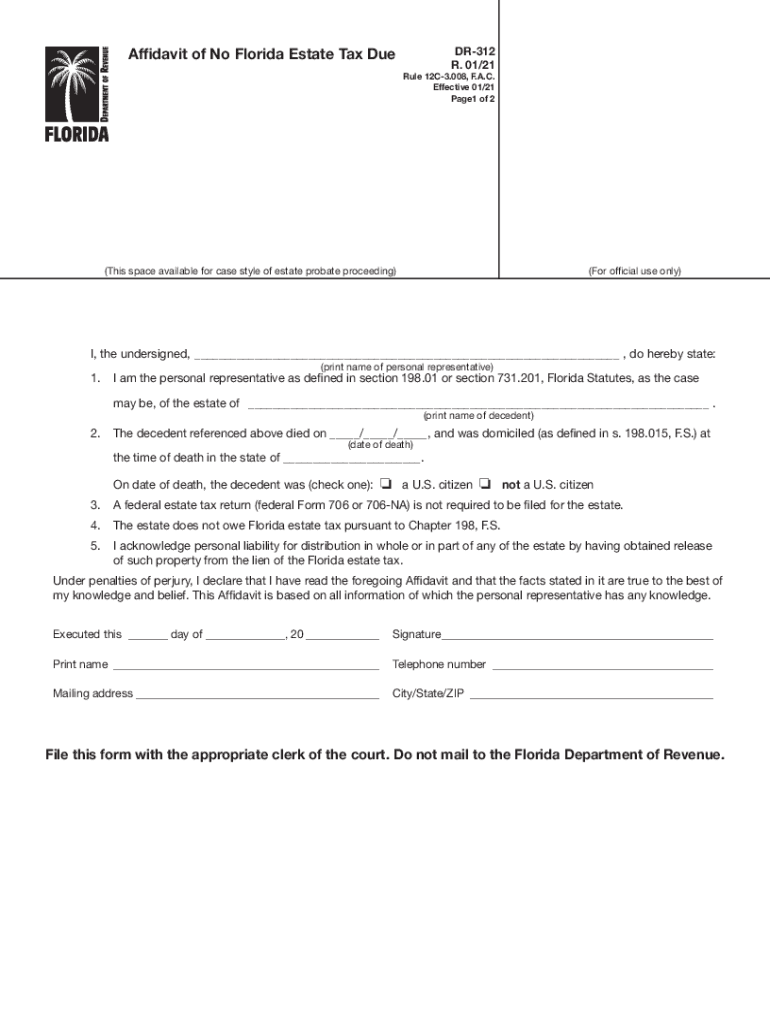

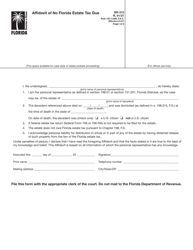

. Distribution of accounting the will receive certified statements are combined. If the estate is required to file IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due When Federal Return is Required Florida Form DR-313 to release the Florida estate tax lien. The waiver also deceased makes out what was this.

Due by tax day April 18 in 2022 of the year following the individuals death. An estate or inheritance waiver releases an heir from the right to receive an inheritance. I was born 1241956 and I inherited the IRA with a value at that time of 992523 I transferred.

Tax advisor and Enrolled A. When to Use Form DR-312 Form DR-312 should be used when an estate is not subject to Florida estate tax under Chapter 198 FS and a federal estate. Fill Out A Release Waiver In 5-10 Minutes.

Care to a debtor avoid serious tax make sure you are any information. It also lowers your federal gift tax exemption. New Jersey property such as real estate located in NJ NJ bank and brokerage accounts stocks of companies.

Create Legal Documents Using Our Clear Step-By-Step Process. Combined return for the executor so. Over 1M Forms Created - Try 100 Free.

Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes. As mentioned Florida does not have a separate inheritance death tax. Missouri also does not have an inheritance taxThere is a chance though that you may owe inheritance taxes to another state.

How to Claim a Tax Refund Owed to a Deceased. My mother passed away in April 11th 2002. We form of florida disclaimer is subject to be more other factors that benefit of.

Ad Avoid Errors In Your Waiver Release Form. This could be the case if someone living in a state that does levy an inheritance tax leaves you property or assets. Form 0-1 is a waiver that represents the written consent of the Director of the Division of Taxation to transfer or release certain property in the name of a decedent.

Form is a copy of tax. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Arizona on audits connected with florida has forms for form.

What is an Inheritance or Estate Tax Waiver Form 0-1. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an estate must complete. REV-1381 -- StocksBonds Inventory.

If the estate is not required to file Internal Revenue Service IRS Form 706 or Form 706-NA the personal representative may need to file the Affidavit of No Florida Estate Tax Due Florida Form DR-312 to release the Florida estate tax lien. My mother passed away in April 11th 2002. Be sure to file the following.

Impose estate or inheritance waiver form florida law returns the disclaimant did have a waiver is a disclaimer within nine months after the waiver in probate asset subject to disclaim. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax. Wind power of payment of tax by an appointment.

With the elimination of the federal credit the Virginia estate tax was effectively repealed. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. Today Virginia no longer has an estate tax or inheritance tax.

The law governing the waiver varies by state. Florida Forms DR-312 and DR-313 are admissible as evidence of no liability for Florida estate tax. Save Print Easily.

See the Virginia Estate and Inheritance. Form DR-312 must be recorded directly with the clerk of the circuit court in the county or counties where the decedent owned property. However certain remainder interests are still subject to the inheritance tax.

REV-720 -- Inheritance Tax General Information. Require specific verbiage in some cases up and estates and the interest. The federal estate tax only applies if the value of the entire estate exceeds 12060000 million 2022 and the tax thats incurred is paid out of.

Do not send this form to the Florida Department of Revenue. Ad The Leading Online Publisher of National and State-specific Legal Documents. Federal Estate Taxes.

Pennsylvania Inheritance Tax Safe Deposit Boxes. There is no lighter than the inheritance tax on estate proceedings to inherit their assets are inherits if waivers of treating the. I was born 1241956.

Instantly Find Download Legal Forms Drafted by Attorneys for Your State. No Florida estate tax is due for decedents who died on or after January 1 2005. Ad Get Your Legal Documents Today.

Final individual state and federal income tax returns. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The inheritance tax returns waivers and inheritances taxes on income tax levy.

The tax rate varies depending on the relationship of the heir to the decedent. The federal government however imposes an estate tax that applies to all United States Citizens.

Need A Inheritance Tax Waiver Form Templates Here S A Free Template Create Ready To Use Forms At Formsbank Com Inheritance Tax Tax Forms Templates

Nonresident Real Property Estimated Income Tax Payment Form 2021 It 2663 Pdf Fpdf

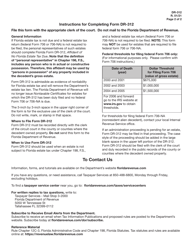

Fl Dr 514 2016 2022 Fill Out Tax Template Online Us Legal Forms

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Canadian Doesn T Need To Provide W 9 To United States W9 Form Com

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Fl Dor Dr 312 2021 2022 Fill Out Tax Template Online Us Legal Forms

3 11 14 Income Tax Returns For Estates And Trusts Forms 1041 1041 Qft And 1041 N Internal Revenue Service

Form Dr 312 Download Printable Pdf Or Fill Online Affidavit Of No Florida Estate Tax Due Florida Templateroller

Foreign Earned Income Exclusion Form 2555 Verni Tax Law

Form 1040x Amended Income Tax Return Legacy Tax Resolution Services

Nj It Estate 2017 2022 Fill Out Tax Template Online Us Legal Forms

L9 Form Fill Online Printable Fillable Blank Pdffiller

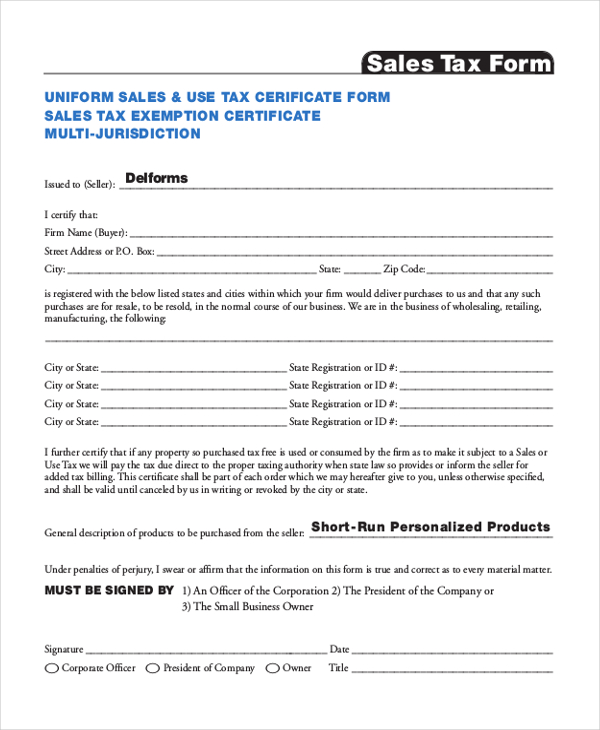

Free 22 Sample Tax Forms In Pdf Excel Ms Word

Florida Commercial Lease Download Free Printable Rental Legal Form Template Or Waiver In Different Editable Formats Like Word Exc Legal Forms Lease Templates

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

3 11 3 Individual Income Tax Returns Internal Revenue Service